Estate Planning

A comprehensive estate plan provides peace of mind, knowing your loved ones will be cared for and your legacy protected. It not only ensures your assets are distributed as you intend, it also eases stress for your family during difficult times. By planning ahead, you give clarity, security, and comfort to the people who matter most.

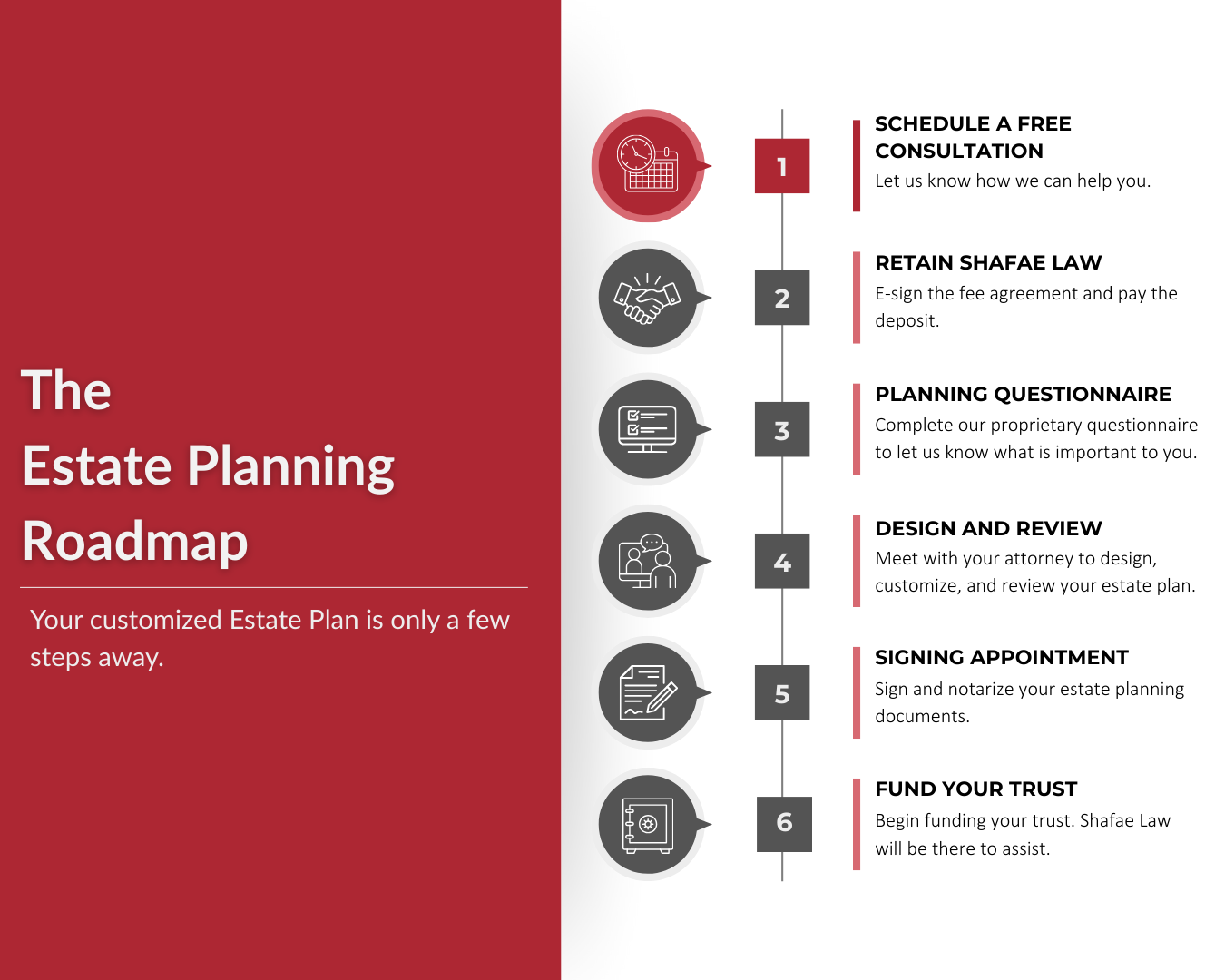

At Shafae Law, we pair legal expertise with a client-focused approach. We take the time to understand your unique goals and guide you through every step of creating a thoughtful, personalized estate plan.

Why Work With Shafae Law?

When you work with Shafae Law, you’re not just getting estate planning services—you’re gaining a long-term partner and resource.

Convenient remote services built for California families: Complete your estate plan from anywhere without taking time off work to commute to appointments.

A thoughtful start: We offer a complimentary consultation so you can determine if our services are the right fit for you.

Real-world insight: Because we also guide families through trust administration, we stay current on best practices in Estate Planning and can help avoid common pitfalls.

Support that grows with you: As your life circumstances change, you can call us with estate planning questions — always free of charge.

Every client who chooses Shafae Law knows exactly what to expect. We charge a flat-fee for a comprehensive, fully customized suite of estate planning tools.

Estate Planning Tools

-

A California revocable living trust is a legal arrangement in which you transfer title to your assets into a trust you control during your lifetime, naming yourself as trustee and a successor trustee to step in when you die or become incapacitated.

Because the trust is revocable, you can amend or dissolve it at any time. At death, the assets pass under the trust’s terms without court-supervised probate, preserving privacy and reducing delay for beneficiaries.

-

A California pour-over will is a short testamentary document that “catches” any assets you forgot to title in your revocable living trust and directs (or “pours”) them into that trust at death.

It names an executor—often the same person as your successor trustee—and can handle guardianship nominations for minor children.

Because the pour-over transfer happens through the will, those leftover assets still pass through probate, so this document serves as a safety net rather than a replacement for proper trust funding.

-

A Durable Power of Attorney (DPOA) is a written authorization in which you, the “principal,” appoint someone you trust as “agent” or “attorney-in-fact” to handle financial and other non-medical matters on your behalf.

Unlike an ordinary power of attorney, it remains valid—or “durable”—even if you later become incapacitated, allowing the agent to pay bills, manage investments, file taxes, or sign legal documents without court involvement.

The principal can amend or revoke the DPOA any time while competent, and the agent must act in the principal’s best interest until the authority ends automatically at the principal’s death.

-

A California Advance Health-Care Directive (sometimes called a medical power of attorney plus living-will instructions) lets you appoint an agent to make treatment decisions and spell out your wishes—such as resuscitation limits or end-of-life care—if you become unable to communicate.

We would be glad to assist you with your Estate Planning needs.

Questions? Email: info@shafaelaw.com or Call: 650-389-9797